The recent collapse of the CryptoBridge Exchange (CBEX) Ponzi scheme has reignited discussions about the persistent issue of fraudulent investment platforms in Nigeria and the role of leadership in addressing them.

CBEX: A Familiar Pattern

CBEX, which began operations in Nigeria in 2024, promised investors 100% returns within 30 days, attracting approximately 600,000 participants. The scheme leveraged purported certifications from the Economic and Financial Crimes Commission (EFCC) and the Corporate Affairs Commission (CAC) to appear legitimate. However, these claims were misleading, and the platform eventually collapsed, leaving many investors with significant losses.

Leadership and Systemic Issues

Analysts have drawn parallels between the operations of Ponzi schemes like CBEX and systemic issues within Nigerian leadership. The argument posits that a culture of impunity and lack of accountability among some leaders creates an environment where such fraudulent schemes can thrive. This perspective suggests that the problem is not solely with the fraudulent schemes themselves but also with the broader governance structures that fail to prevent them.

Regulatory Response

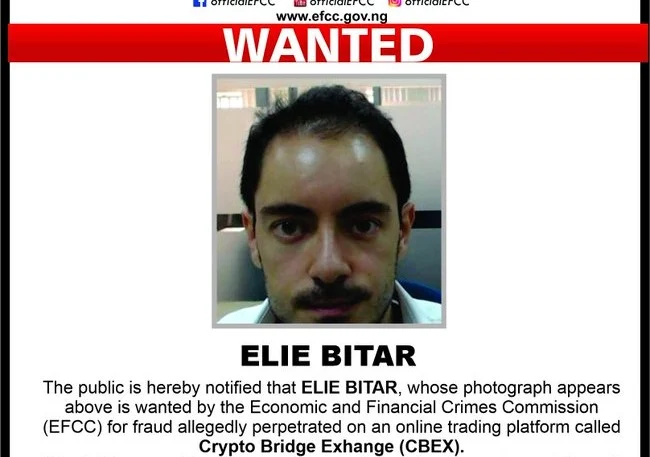

In response to the CBEX collapse, the EFCC has initiated investigations and is collaborating with international agencies like INTERPOL to track down the perpetrators and recover lost funds. The Securities and Exchange Commission (SEC) has also emphasized the illegality of unregistered trading platforms and warned against promoting such schemes.

Public Awareness and Vigilance

The recurring nature of Ponzi schemes in Nigeria underscores the need for increased public awareness and financial literacy. While regulatory bodies play a crucial role in enforcement, individuals must exercise due diligence and skepticism toward investment opportunities that promise unusually high returns with little risk.

.jpg)